Clearing and Custody

Count on Apex Clearing, wholly owned subsidiary of Apex Fintech Solutions, to be flexible, secure, and proven at enterprise scale. Use our clearing and custody engine to enable real-time processing, expand investing options beyond traditional market hours, and provide global access to U.S. markets.

Real-time transaction processing

Use our modern clearing and custody engine to streamline operations, reduce errors, and deliver real-time solutions that scale with your business needs. Apex Clearing is backed by:

- Regulatory expertise

- Trading and technical operations desks

- Robust data security protocols

- Rigorous risk management

Read on to explore the features:

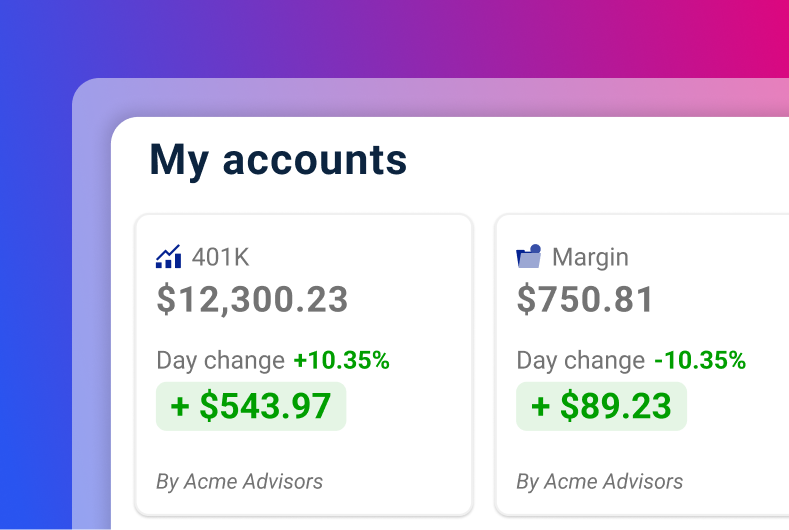

30+ Account types

- Individual

- Joint

- Retirement

- Individual margin

- Institutional

- Trust

- Entity

- And more

Access 24/7 real-time data

Meet our real-time books and records ledger, your single source of truth for up-to-date account data 24/7. Instead of waiting for end-of-day files or creating reference points to keep intraday data in sync — you and your systems have what’s needed to take action in the moment.

- Process transactions and track positions as they happen

- Run calculations based on real-time account activity, positions, balances, and more

- Get comprehensive real-time event updates via API

6 use cases for a real-time data warehouse

Read our whitepaper, “The Power of Real-Time Data Access,” and see 6 ways a real-time data warehouse can transform the way your business operates.

Asset classes

Broad asset class coverage

- U.S. equities

- Mutual funds

- ETFs

- Options

- Futures

- Fixed income

- Alternative assets

- ADRs and foreign securities

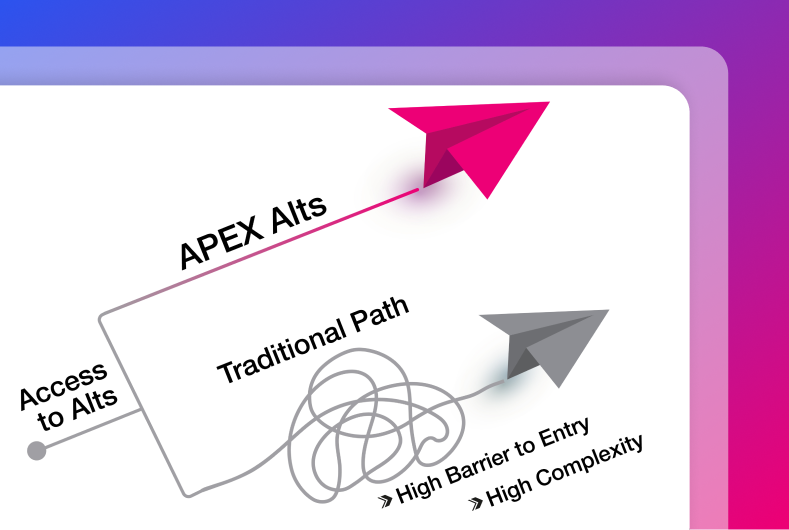

Alternative investments

With Apex Alts, you can offer alternative investments alongside traditional asset classes. Make the process of buying alts as straightforward and familiar as the process of buying mutual funds.

- Plug into the Apex Alts Marketplace

- Lower barriers to entry

- Expand access

- Reduce the implementation lift with one cohesive solution

Corporate actions

Streaming corporate events

With Apex AscendOS and its real-time ledger, you can automatically process corporate actions as they happen — as streaming events.

Real-time event processing

This includes stock splits, dividends, mergers, plus more uncommon scenarios and unpredictable industry events.

Near-instant error corrections

Fix errors and move forward right away. No need to wait until the next day.

Real-time risk management

Make decisions and answer customer questions based on an up-to-date intraday view of positions and pricing.

FPSL

Fully Paid Securities Lending

Generate additional revenue while enabling clients to earn passive income on their fully paid securities with the Apex FPSL solution. Designed to simultaneously deliver value to your business and investors.

- Wide range of securities available

- Real-time stock locates and quotes

- Digital opt-in process integrated into account opening

- Direct API integration

Margin lending

Margin lending

Create opportunities for leverage within investors’ portfolios, directly integrated to your investment infrastructure.

Multiple financing options

Real time quotes

Direct API integration

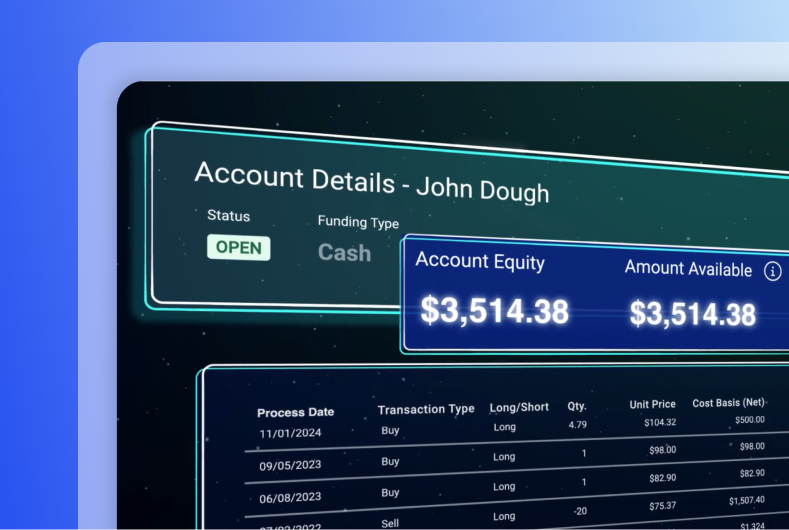

Cost Basis and Tax

Cost basis processing and tax reporting

Apex cost basis and tax automates complexity

Formerly known as Apex Silver, our unified cost basis and tax platform can help you cut the drama (and total cost of ownership) associated with cost basis and tax reporting. All backed by cloud security and a support team of subject matter experts.

Get real-time automatic reprocessing

Automate complex processes

Provide one-click transparency

Get in touch with a human

Fill in your information and our team will reach out to answer your questions.