Automated income reclassification

Apex Cost Basis and Tax can minimize year-end workloads with daily automated income reclassification processing.

Formerly known as Apex Silver, Apex Cost Basis and Tax helps reduce the chaos required for cost basis calculations and tax reporting. All with detailed traceability that empowers users to view, understand, and trust every calculation and adjustment made.

Apex Cost Basis and Tax uses real-time data and automated calculations to help you save time (and sanity). Reduce manual errors while processing enterprise-scale volumes of trades, wash sales, corporate actions, income reclassifications, and more.

Available as a unified platform or standalone modules, Apex Cost Basis and Tax is proven at scale.

Use case snapshot

Pump the volume — keep the speed

Here’s how one client used Apex Cost Basis to process very high volumes of account activities over a five-day period in 2025.

* The service level agreement measures the time from when the first input is received by Apex to when the output is sent by Apex to the client. Apex data as of 1/31/25.

Apex Cost Basis and Tax enhances transparency with data traceability and explainers, reducing prep time and simplifying operator workflows.

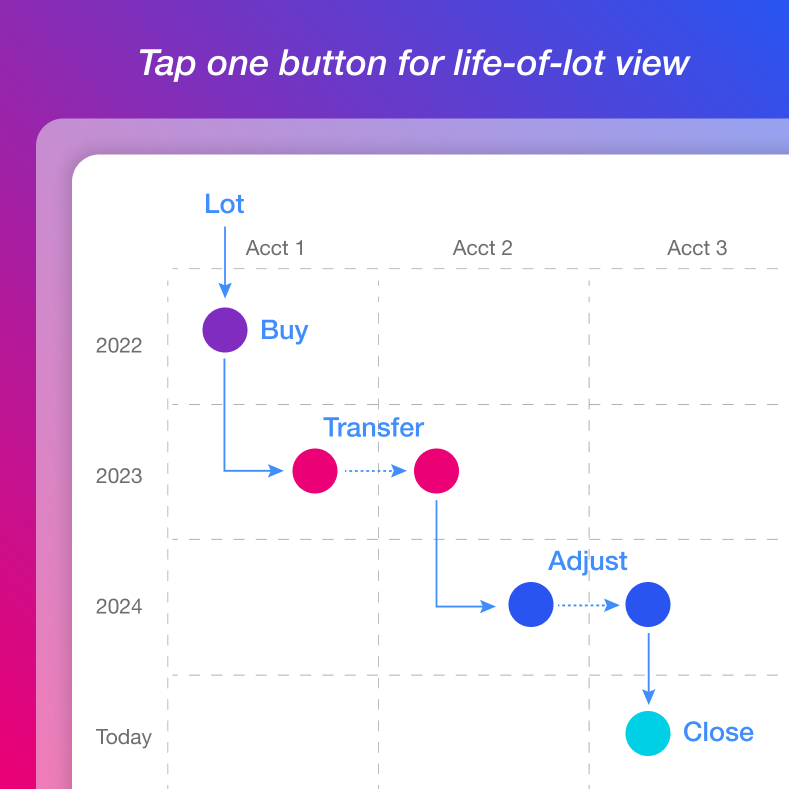

Life-of-lot explainers that show the work behind processing decisions and breaks when they do occur

As-of views and forms for a clear understanding of what an account looked like before and after an event

Consolidated view of transactions so you can see multiple accounts and security movements in one view

Reprocessing

No waiting on batch processing or reconciliation breaks. See real-time updates, including as-of and what-if views, any time you change input data.

Apex Cost Basis and Tax can minimize year-end workloads with daily automated income reclassification processing.

Leverages back-office activity to validate and trigger tax lot adjustments automatically, eliminating 99.99% of reconciliation breaks.

Count on our “show your work” transparency and predictive views when processing complicated assets like fixed income and crypto.

Use case snapshot

Want to reduce breaks close to zero?

Here’s how one client used Apex Cost Basis to process volumes of reconciliations over a five-day period in 2025.

**Apex data as of 4/7/25

Available as individual modules, as part of our clearing offering, or Saas for self-clearing clients.

Real-time cost basis processing

Tax reporting

Income reclassification

Unified Apex Cost Basis and Tax system

Want less stressful cost basis and tax processing?

Provide your information, and our team will reach out to talk about how modern technology can reduce your workload.