Rebalancer dashboard

Save time with a filtered view that lets you see which accounts need rebalancing so you can propose trades more efficiently.

Simplify and automate the process of giving your full book of client accounts the customized, sophisticated investment strategies that they want. Just set the thresholds based on pre-defined upper and lower bounds to see all accounts that are out of desired thresholds and accept proposed trades.

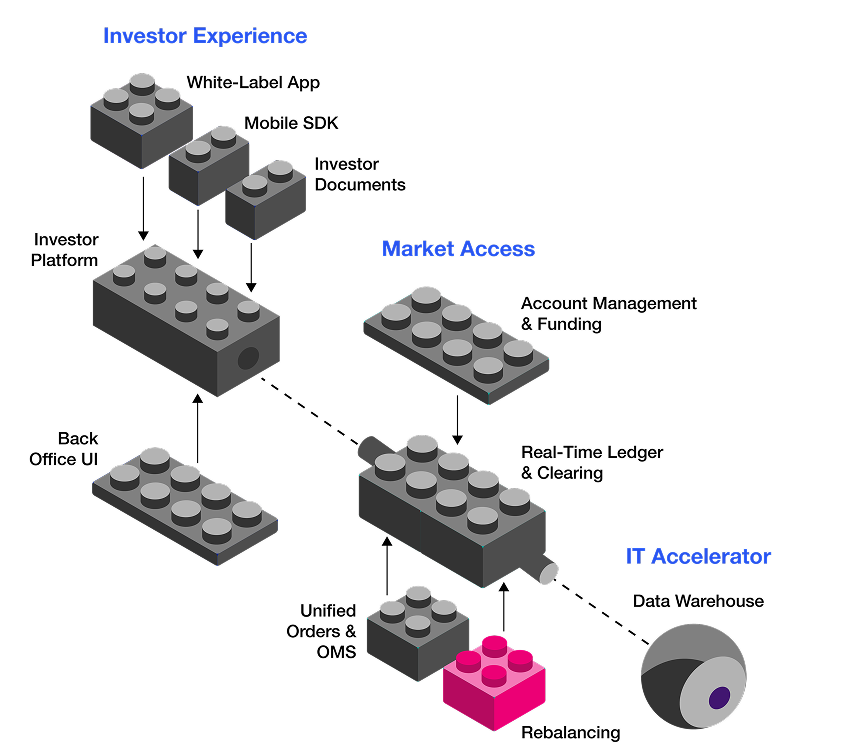

With Apex Rebalancer’s automation workflows, you can help clients get personalized treatment without a heavy operational burden. Then use our real-time rebalancing to handle tens of thousands of accounts at once.

Save time with a filtered view that lets you see which accounts need rebalancing so you can propose trades more efficiently.

Get detailed explanations with an audit trail for why each transaction is (or is not) proposed, including single securities and fractional shares.

Use time-based or risk-based glide path automation. Use our platform or plug into our API to assign accounts to goals, including multiple accounts for a single goal.

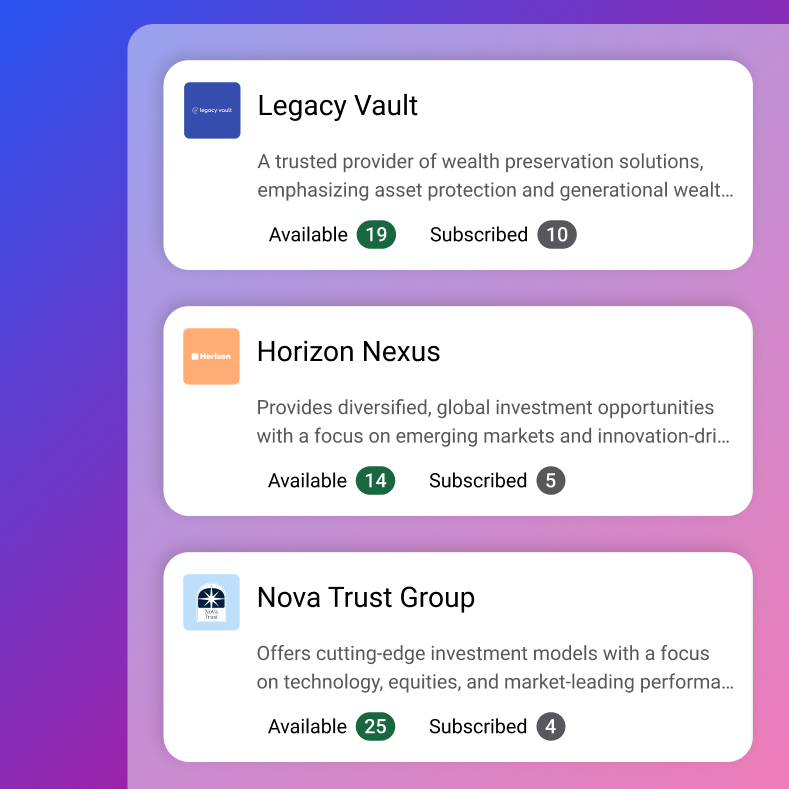

Access a broad library of models from professional asset managers, allowing advisors to select models that align with their clients’ objectives and helping save time on portfolio construction.

Get personalized direct indexing with tax loss harvesting capabilities, enabling screening for ESG, tax optimization, and other investment preferences.

Embed Apex Rebalancer into your existing workstation with multiple clearing firms, even if Apex isn’t one of them

Break free from limited rebalancers

Unlock refined rebalancing without manual calculations and overnight delays.