Treasury Management from Apex: More Investing Opportunities, Less Manual Work

Designed to help treasury management companies, B2B fintechs, payroll providers, educational institutions, foreign-based broker-dealers, or any other business gain yield on idle cash.

Benefits of Treasury Management from Apex

Integrate Apex’s treasury components with your existing Treasury Management System (TMS) to help expand and execute your cash management program with a suite of tools designed for professional investment managers.

Leverage a Broad Array of Securities

Access a multitude of fixed income and mutual fund securities, many available in whole and or fractional amounts.

Enable Passive Income Generation

Use FDIC Sweeps or Money Market Sweeps to optimize idle cash in entity accounts — or just FDIC Sweeps for individual accounts.

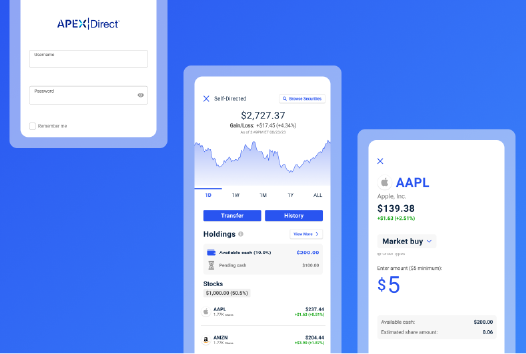

Build Less, Upgrade to a Sleek Experience

Embed our white-label trading UI, Ascend Investor, in your existing Treasury Management System (TMS) to lessen development and UX/UI work.

Let Go of Overnight Batch Processing

Get real-time — not legacy overnight batch — processing with our cloud-native, real-time Apex AscendOS™ infrastructure.

Leverage Apex Direct’s FINRA Registration

If your company isn’t in the wealth industry, you can leverage our introducing broker-dealer, Apex Direct, for your FINRA registration* to help save time and money.

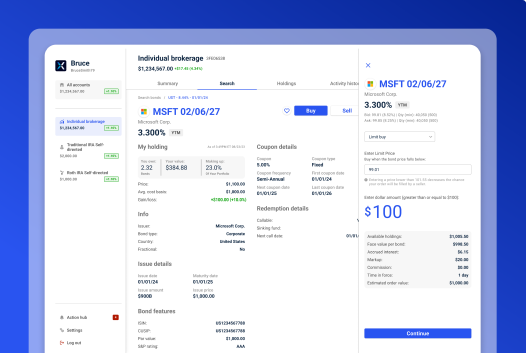

Use One Unified Investing Screen

Packed with useful tools, the Ascend Workstation is your centralized hub for treasury investing.

*Note that Apex Direct users only have access to U.S. investment-grade fixed income securities.

Modern Investment Capabilities for Treasury

Apex’s treasury management offers a comprehensive suite of professional-grade features designed for fintechs adding treasury management or treasury firms looking to upgrade their investing solution. Use all of the automations and advanced tools, not just a “lite” or “starter” version for your cash management program.

- Get a real-time solution that provides the up-to-the-moment positions and cash balances you need from your treasury management to stay up to date with the rest of your TMS — as opposed to legacy investment solutions that rely on overnight batch processing, often lagging 24 hours behind

- Use our sophisticated Order Management System (OMS) and integrated Execution Management System (EMS) designed to help achieve best execution

- Optimize precise portfolio allocation with access to fractional shares of many fixed income and mutual fund securities

- Use the Ascend Workstation user interface (UI) to manage all investing activities, as opposed to legacy systems that can require multiple tabs, screens, and logins

More Securities, More Opportunities

Access a wide range of fixed income, mutual fund assets, and other potential income-generating solutions to enable a wider array of treasury investment strategies.

Fixed-Income Securities

Government

- Treasuries

Corporate

- U.S. Investment Grade

- U.S. High Yield

- Brazilian Corporate Bonds

- USD Denominated European Credit

- USD Denominated Asian Credit

Municipals

- U.S. Municipals

Certificates of Deposit

- U.S. Brokered CDs

- USD Denominated Foreign Brokered CDs

Coming Soon

- U.S. Structured Products

- U.S. Convertible Bonds

- U.S. Commercial Paper

Mutual Fund Securities

- Mutual Funds

- Money Market Mutual Funds

Automated Cash Management Programs

FDIC Sweeps Program

- Automatically sweep uninvested cash balances into deposit accounts at participating banks, with access to up to $5 million in FDIC insurance coverage per account

Money Market Sweeps Program

- Automatically sweep idle cash balances into an interest-earning Money Market Fund. These accounts are protected by SIPC for up to $500,000 total, which includes a $250,000 limit for cash

Accelerate Your Treasury Software Launch

When you work with Apex, you can expect a modern developer experience designed to shorten your deployment timeline. In fact, by requesting access to our Developer Portal, your team can start experimenting with our infrastructure now by creating proof-of-concepts in a secure sandbox, then smoothly transition to UAT.

- Integrate via white-label UIs, SDKs, or REST APIs — depending upon your specific needs

- Customize the out-of-the-box, white-label Ascend Investor web and mobile app user interface (UI) screens instead of building your own from scratch

- Automate many investing administrative tasks

- Use Apex Direct for introducing broker-dealer FINRA registration to access U.S. investment-grade fixed income securities instead of pursuing your own registration

A Few Automated Treasury Investing FAQs

With our real-time infrastructure, cash from all sources — including liquidated positions and dividend payments — is reflected in your balance immediately, giving you a true intraday view of your liquidity.

For Liquidated Positions: Proceeds are available in your cash balance the moment the trade is executed. This allows you to redeploy capital faster and more efficiently without waiting for overnight batch processing.

For Dividend Payments: You have the flexibility to choose how dividends are handled, and the action is processed in real time.

- Cash Payouts: Dividends can be paid directly into your cash account, making the funds immediately available for other uses.

- Dividend Reinvestment (DRIP): Alternatively, you can have dividends automatically reinvested to purchase additional units of the security, such as a money market mutual fund. Your updated, larger position is reflected instantly.

You have significant flexibility in customizing both the user interface and the underlying workflows. Our approach is designed to be more “mix-and-match” than “build-or-buy.”

UI and Brand Customization

You can fully brand the white-label investor experience. This includes tailoring the following elements to match your corporate identity:

- Logo: Seamlessly integrate your company logo

- Color Palette: Apply your specific brand colors and gradients

- Typography: Use your designated brand fonts

- Iconography: Incorporate your own set of icons

- Brand Voice: Ensure the language and tone align with your brand

Development Pathways

You have a spectrum of options to control the workflows, depending on your development resources and desired speed to market.

- White-Label Deployment: Use our pre-built, standalone user interface for the fastest path to market with minimal engineering effort from your team

- Embed With SDKs: For more control, you can embed our front-end SDKs into your existing application. This allows you to use our core functionality as a base and then layer your own custom experiences and workflows on top

- Build With APIs: For maximum flexibility, you can build a completely custom experience from the ground up using our comprehensive suite of APIs. This approach lets you create unique workflows and integrate our capabilities directly into your proprietary systems

For many of our clients, Apex Insights — our pre-built BI tool that’s integrated with the AscendOS infrastructure — is the only data reporting and visualization tool they use.

One of the primary reasons to choose Apex for your treasury investing software is that we give you access to your own real-time investment data 24/7 — unlike other custodians that don’t — so you can use our built-in BI tool to:

- Build custom reports and visualizations from scratch — and then run them on a regular or ad hoc cadence, as needed

- Customize dashboards (starting with pre-built versions) to help track the key performance and risk metrics that matter most to your business

- Conduct direct queries whenever you want

- Use self-service permissions to give other employees access so they can use Apex Insights, too

- If you need to download and export data for use in another BI tool, you may choose to:

- Use our Data Retrieval API to access and download your data as Snapshot files in Apache Parquet format

- Export your data from your private data warehouse in standard CSV, TXT, XLS (Excel 2007 or later), JSON, HTML, Markdown, PNG, or PDF

Our system provides a spectrum of control, from fully automated to direct and hands-on execution. Our configurable smart routing system and broad market access, detailed in our Trading Fact Sheet, provide these primary ways you can control your trade execution:

- Configurable Order Management System (OMS): Our OMS is not a one-size-fits-all solution. We can work with you to configure the trading experience and pre-trade risk checks (such as real-time buying power) to meet your specific institutional needs

- Smart Order Routing and Market Access: Our systems are designed to help you achieve best execution without manual intervention. We provide access to a full range of direct market access, including traditional and non-traditional liquidity providers and venues for various asset classes

- Flexible Order Submission: You have the flexibility to submit orders programmatically via our consolidated Orders API for systematic trading or enter them manually through the Ascend Workstation operational UI for more direct, hands-on oversight

- Versatile Order Types: The platform handles whole, fractional, and notional-based orders, which gives you precise control over allocation. This versatility is especially useful for managing fixed-income and mutual fund portfolios and rebalancing strategies

- Dedicated Trade Desk Support: For more complex execution needs, you have direct access to our dedicated Trade Desk. Staffed by veteran professionals, this team provides custom support and expert analysis to help optimize your routing strategies, improve execution quality, and refine your overall trading workflows.

The Apex service experience is built to be efficient, giving you fast resolutions through a blend of self-service tools and human help. Here is what our support model looks like:

- Efficient Digital Service Center: You can submit service tickets online in under a minute* through our Digital Service Center. During U.S. business hours, you can expect a response within 30 minutes** and can monitor the progress of your request with a single ticket number

- Self-Service Tools: Our platform is designed to give you as much direct control over issues that historically required submitting a ticket, such as managing user permissions or updating client information

- Dedicated Human Support: You are assigned a personalized service team that acts as your direct point of contact for complex, urgent, or high-touch escalations

- Proactive Education: We don’t just wait for problems to arise. Instead, we track emerging service issues so we can help you preempt potential issues before they impact your operations

Looking for Treasury Software to Support Your Cash Management Program?

Talk to an Apex rep about how we can help gain yield on idle cash while maintaining critical liquidity.