Count on Our FINRA Registration

When your primary business is not in wealth management, you can lean on our broker-dealer registration and operational support

Apex Direct is designed to support businesses that want to offer embedded investing with a turnkey solution that includes leaning on Apex’s broker-dealer FINRA registration.

Our Brokerage-as-a-Service bundle includes regulatory, brokerage, custodial, and technology services. Whether your business operates domestically or internationally, we can equip you with the necessary tools, products, and UI experiences to launch your investment capabilities on your own timeline.

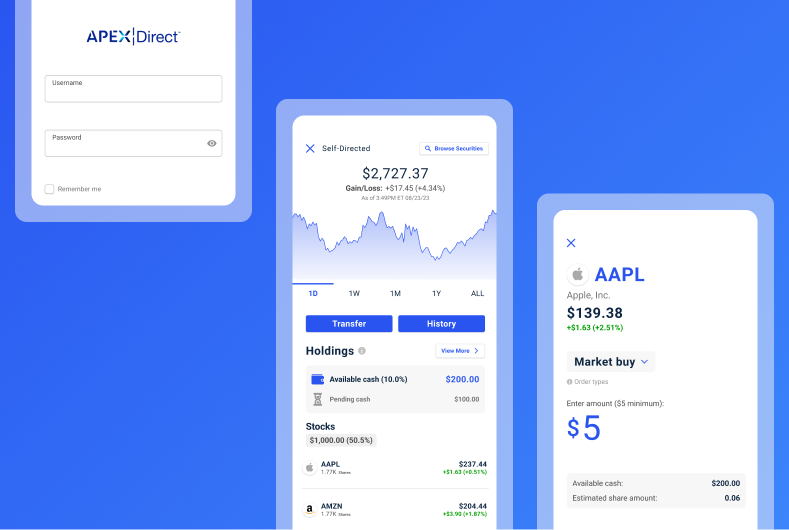

Use our modern developer experience — including REST APIs and white-label desktop, web, and mobile UIs — to embed our cloud-native technology in your existing digital ecosystem, empowering your clients to invest from their smartphones.

When your primary business is not in wealth management, you can lean on our broker-dealer registration and operational support

Use APIs, SDKs, or UIs to connect with our real-time custodial services (that no longer rely on overnight batch processing)

As part of our Brokerage-as-a-Service offering, we’ll manage the operational tasks so you don’t have to staff up

FINRA (the Financial Industry Regulatory Authority) is a not-for-profit organization authorized by Congress to protect investors by making sure the broker-dealer industry operates fairly and honestly. Among other responsibilities, FINRA licenses and registers professionals who work in securities, writes and enforces industry rules, and monitors market activity for potentially fraudulent activities.

FINRA registration can be time-consuming and expensive:

Receiving FINRA registration approval can take several months

— or even up to a year— which may delay your opportunity to start earning revenue from new offerings

Expenses associated with registration can vary widely

depending upon whether you hire consultants or legal advisors — and it can take months or longer to receive FINRA registration, along with incurring substantial fees

There are many ways to leverage Apex Direct’s Brokerage-as-a-Service offering, but these are the most common. If your vision isn’t on this list, talk to an Apex rep — there’s a good chance we can help you create a solution.

If you’re worried about ongoing brokerage operational requirements — think staffing up and keeping up with ever-changing regulatory requirements — you can relax knowing that the Apex Direct Brokerage-as-a-Service solution includes these behind-the-scenes functions:

There are several steps required after a trade order is placed. Apex technology and personnel can handle trade confirmation and settlement on your company’s behalf.

Day-to-day account management tasks such as updating account details (like a change of address), transferring assets, moving money, and more are handled by Apex Direct staff or technology.

Corporate actions can change the securities held in an individual investor’s portfolio through stock splits, mergers, acquisitions, dividend payments, and more. Apex’s Brokerage-as-a-Service technology can update the affected portfolios automatically.

Keep your investors informed with trade confirmations, account statements, cost basis calculations, and tax reporting that are automatically generated.

Provide a modern investing experience with the cloud-native Apex AscendOS custody, clearing, and trading infrastructure that powers the technology included with Apex Direct.

Get Pre-Built, White-Label User Interfaces

Use configurable screens for desktop, web, and mobile rather than developing them yourself

Support 30+ Account Types

Provide the types of brokerage accounts your customers need, including individual, joint, retirement, institutional, entity, and more

Offer Access to Fractional Shares

Help make every investable dollar count by offering fractional shares of equities and many fixed income securities

Expand Your Asset Classes

Enable your investors to diversify their portfolios with access to equities, fixed income, ETFs, and mutual funds

Automate Tasks to Work More Efficiently

Use elegant workflows designed for professional financial advisors such as automated rebalancing and corporate actions

Rely on the Apex Service Experience

Get faster resolutions when you need them with the Apex digital service experience that includes self-service and help from a dedicated point person

Is the Apex Direct Brokerage-as-a-Service Right for You?

Get detailed answers to your most pressing questions by requesting a one-to-one conversation. Provide your information, and one of our reps will reach out soon.

Apex Fintech Brokerage Services LLC (doing business as Apex Direct) and Apex Clearing Corporation are SEC-registered broker-dealers and members of FINRA and SIPC. Both are wholly owned subsidiaries of Apex Fintech Solutions Inc. Securities products and services offered on this site are provided by Apex Clearing Corporation and Apex Fintech Brokerage Services LLC. Apex Clearing Corporation acts as the clearing firm for Apex Fintech Brokerage Services LLC, providing custody, settlement, and back-office support for client securities transactions.

Apex Fintech Brokerage Services and Apex Clearing Corporation are both licensed and registered to conduct securities business in 53 U.S. states and territories.

To check the background of these firms or their investment professionals, visit FINRA BrokerCheck at http://www.finra.org/brokercheck. For additional information about SIPC coverage, visit www.sipc.org.