Self-directed investing

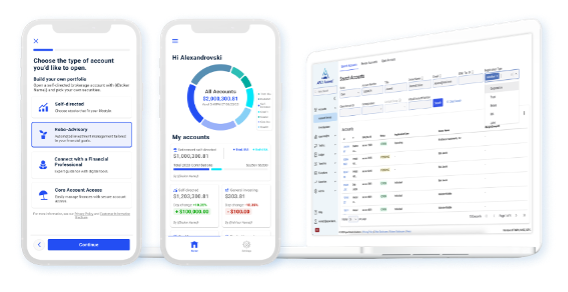

Empower investors who want full control over their investing decisions. We offer access to fractional shares, a client portal, and an optional white-label mobile app

Looking for a configurable, white-label wealth management solution that can help you launch up to 50% faster?* What if it could also provide real-time data, cloud-native infrastructure, algorithmic workflows, and a mobile app? Meet Ascend Investor, the API-driven tech designed to help you build your own platform with greater ease.

Build your own trading platform with Ascend Investor, which is purpose-built to provide a comprehensive solution for advisory firms undergoing a digital transformation, fintechs seeking to embed new investing functionalities, and other businesses looking to expand their revenue models.

Key benefits

Save build time with provided UIs

White-label, configurable screens for desktop, web, and mobile applications can help save development time

Choose rapid deployment or flexible integration

Connect to Ascend Investor using our white-label UIs for the shortest possible launch timeline or integrate just the features and components you need via APIs.

APIs, SDKs, or white-label, configurable UIs — all designed to help you launch 50% faster* without a heavy development lift

Count on portfolio construction automations

For example, Risk Tolerance Questionnaires (RTQs) are algorithmically integrated with our Model Marketplace and Rebalancer to streamline portfolio selection and management

Unlock potential new revenue streams

Attract new clients with a robo, self-directed, or Augmented Advice™ business models — and unlock potential revenue streams with flexible client engagement approaches

Count on our vertical integration to reduce vendor spend

Unlike fragmented solutions, Ascend Investor delivers an integrated platform that includes pre-built front-end UIs, middle-office workstations, back-end APIs, and more

Use real-time tools based on real-time data

Operate in real time with an embedded data warehouse, a real-time ledger, digital account opening and funding, streamlined money movement, intraday automated rebalancing, and more

*Based on Apex client experience of a 12 to 24 month predicted timeline versus six-month actual timeline.

White-label, configurable UIs

Out-of-the-box embedded investing screens

Investment models

Apex Investor supports a spectrum of investing business models to empower your company to build your own platform using one approach — or a blend that suits your needs.

Empower investors who want full control over their investing decisions. We offer access to fractional shares, a client portal, and an optional white-label mobile app

Add personalization to your robo model with pre-built client Risk Tolerance Questionnaires (RTQs) that are algorithmically integrated with our Model Marketplace and Rebalancer

Use this hybrid business model, which combines robo advising with on-demand human advice, rather than building your own platform from scratch

With tech-forward automations, the classic white-glove advising model can become more efficient when you use automated tools such as the Apex Rebalancer and our pre-built end investor portal

Use cases

Ascend Investor is designed for businesses that want to launch investment capabilities without the development burden of building from scratch or hand-coding to legacy technology. It can be used as your firm’s primary clearing, custody, and trading solution or as an embedded trading platform.

Advisory firms and broker-dealers

Both startups and established firms can use Ascend Investor to create a modern, differentiated retail investing experience

Fintechs

Instead of hand-coding to a legacy platform, use our REST APIs to add embedded investing to your existing tech stack

International companies

Embed access to the U.S. markets in your existing technology, including pre-built screens

Financial institutions

Help establish your bank or credit union as a financial hub by adding embedded robo or self-directed investing services

Let your team focus on growing your business instead of dealing with software management. Use our unified, flexible Ascend Workstation to help advisors and operations teams enhance their efficiency and productivity when they need to:

Assets & accounts

Expand your offerings to help attract and retain all types of investors, including non-U.S.-based customers.

30+ types, including:

Ready to use Ascend Investor to build your own platform?

Download the detailed fact sheet or take the next step by completing this form to start a conversation with an Apex rep. You’ll hear back soon, so you can ask your questions and get more details.