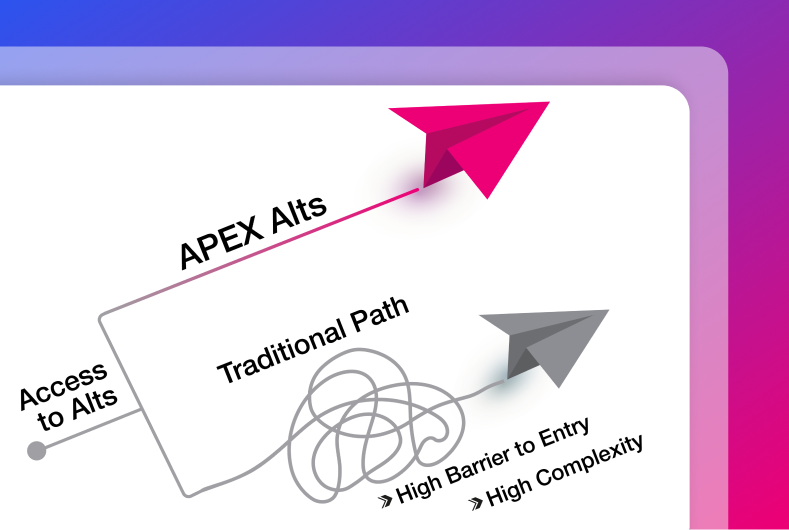

Apex Alts: Alternative

investments built in,

not bolted on

Alternative investments are now as seamless

to purchase and manage as traditional asset

classes with one platform, one user interface (UI),

one account, and one custodian.

Offer alternative and traditional assets side-by-side

Investors, advisors, and broker-dealers can enjoy a unified experience that brings alts into the same brokerage accounts and workflows as other assets classes.

Use one platform for the full subscription lifecycle

Streamline account opening, funding, pre- and post-subscription processes (account registration, security profile, trading, settlement, distribution, activity, transfers, and position reconciliation), reporting, valuation, investor communications, and more. Operate more efficiently with digital document delivery, signature processing, and validation. Plus, built-in integration to DTCC AIP can help standardize alts processes to run your experience more smoothly. Read the Apex Alts and Alts Marketplace Fact Sheet for more details.

Easier implementation with cloud-native infrastructure

Apex Alts is built on our cloud-native Apex AscendOS™ clearing, custody, and trading platform.

- Connect with a modern developer experience that includes a sandbox environment, APIs, SDKs, user interfaces (UIs), and more

- Plug into off-the-shelf accreditation modules and the Ascend Workstation, a unified advisor and enterprise view

- Leverage Apex Alts (and the Alts Marketplace) as a SaaS solution, even if you don’t clear and custody with Apex

Access thousands of alternative investment options

Apex Alts is not limited to one third-party marketplace. Instead, the Apex Alts Marketplace aggregates thousands of funds through integration with major alternatives platforms.

- Pre-IPO SPVs*

- Hedge funds

- Funds of funds

- Private equity

- Non-traded REITs

- Private company shares

- Private credit

- Limited partnership interests,

- Business development companies (BDCs)

Or even bring your own alternative fund

Fund issuers, transfer agents, asset managers, and the DTCC AIP participants, you can expand your fund’s reach by adding it to the Apex Alts Marketplace where it may be exposed to our 20M+* institutional, accredited retail, and non-accredited retail participants.**

Streamline regulatory and operational processes

Apex Alts document and statement management nearly eliminates copious amounts of manual, back-office work and paperwork

Built on the AscendOS real-time ledger, Apex Alts provides real-time data to help keep your books and records up to date

Centralize documentation, account and tax statements, signatures, and reporting to help reduce errors and operational headaches

Are you ready to offer an integrated, seamless alts experience?