Serving 401(k) Third-Party Administrators (TPAs)

Make 401(k) rollovers and force-outs easier for everyone involved. Apex helps retirement plan TPAs offer a seamless digital transfer experience, retain more assets, and deliver a fast solution that can narrow the gap between old accounts and new ones.

“Our plan participants and financial advisors are always asking us to expand our range of services we offer. We listened and decided that instead of building this new functionality slowly ourselves, we’d fast track it with Apex’s embedded brokerage infrastructure as our launchpad.”

Stan Smith

Chief Growth Officer at 401GO

The comments expressed here may not represent all client experiences. These statements are not meant to indicate any guarantee of future performance or success.

Offer fully digital rollovers to help retain assets

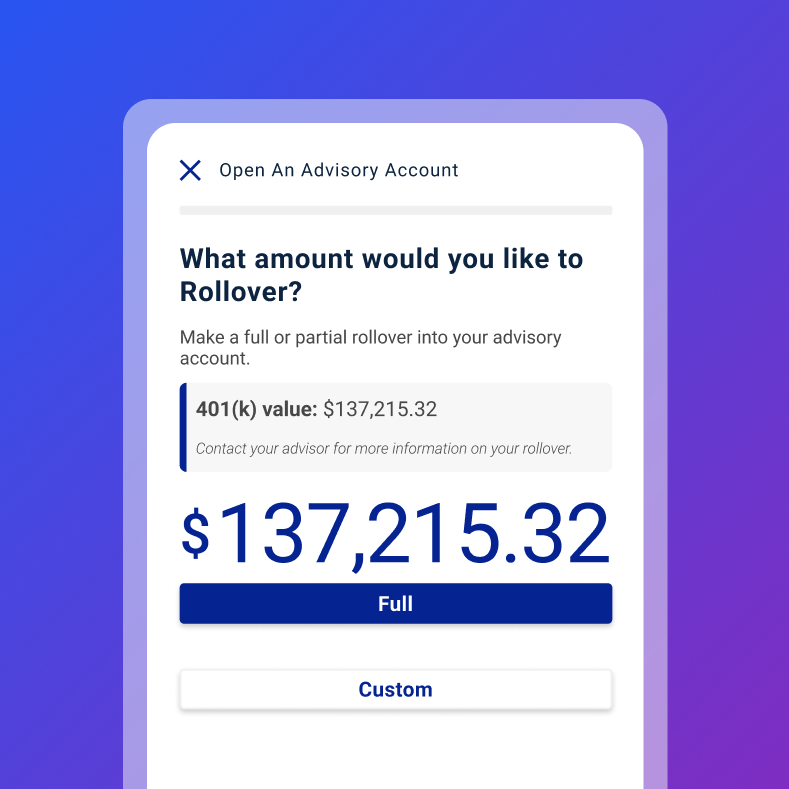

Designed to empower 401(k) and other plan TPAs who want to provide a simpler way for participants to move funds when they switch jobs or experience automated force-outs. Instead of a weeks-long process, our Instant Cash Transfer services give your firm the ability to rollover accounts from employer plans to Individual Retirement Accounts (IRAs) in minutes.

Use our comprehensive digital 401(k) rollover solution available

Give account holders more rollover options within your business

Retain more assets under your management

Support accounts of any size with a tech-forward, real-time solution

Enable a robo or self-directed retirement investment experience

Reimagine the rollover process with Ascend Investor

Ascend Investor provides the front-end tools TPAs need — plus pre-built, white-label user interfaces. Skip the paper-and-check process that can take weeks and choose a fully digital solution designed to help retain assets and compete with larger providers. Learn how 401GO used these features to offer a unique rollover experience:

- Open new accounts in seconds*

- Use Apex’s instant cash transfer capabilities, available 24/7/365, instead of relying on paper checks

- Streamline rollover workflows for you and your customers

- Provide emergency saving solutions alongside retirement planning

- Get pre-built user interfaces that can be integrated into your existing experience

- Lean on Apex technology for clearing, custody, and trading solutions

- Skip the hassles and delays associated with becoming a registered broker-dealer

Discuss the details

Get answers to your specific questions by initiating a one-to-one conversation. Provide your information, and one of our reps will reach out.