New, novel, and memorable

Differentiate your loyalty program with a fresh and exciting loyalty reward for everyday purchases.

Expand wallet share and become your customers’ financial hub. Embed sleek trading experiences into your offering without building yourself or standing up additional broker-dealer licensing.

Embedded investing

Your customers expect fully digital investing experiences. You’d like to consolidate vendors to save time and money. Apex can meet both needs. Choose a comprehensive embedded investing experience or just the modules you need to enhance your existing offering.

Designed for retail financial institutions, Apex offers a suite of cloud-native solutions that can simplify how you provide wealth management services, including:

Turnkey investment customization

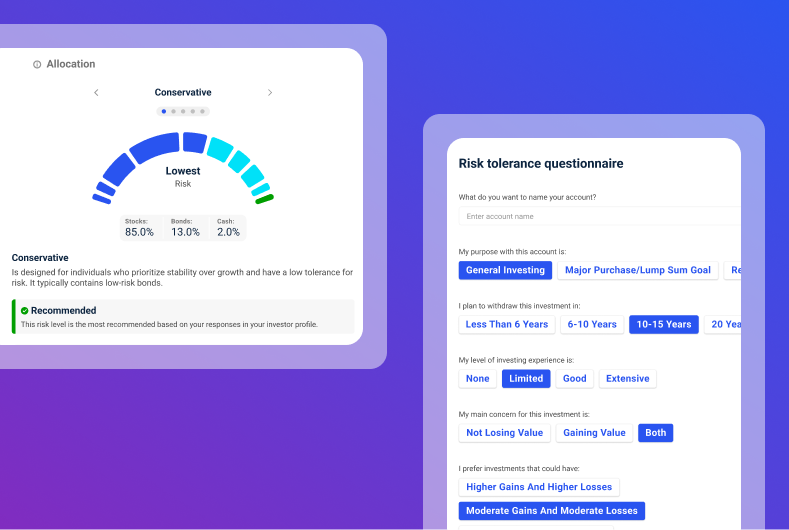

Get pre-built investment tools, including customizable UIs, configurable risk and goals assessments, and automated portfolio mapping and rebalancing

Keep your brand front and center

with white-label desktop and mobile app UIs

Cloud-native technology

Don’t get boxed in with legacy wealth tech — get real-time services and solutions

Digital customer tool

Give customers self-service opportunities to reduce the demands on your staff

Registered or non-registered entities

We can tailor our solutions to your specific regulatory situation

With AscendOS’s cloud-based infrastructure, it’s easier to build, integrate, scale — and operate globally.

AscendOS

Apex is proud to introduce Apex AscendOS, our cloud-native clearing, custody, and trading platform designed to meet the expectations of today’s digital investors.

AscendOS eclipses legacy platforms with real-time (not overnight) services, automated solutions (not manual workarounds), and many pre-built specialty tools.

Real-time services replace overnight slowdowns

Pre-built tools so you can minimize extra work

Choose Ascend Investor and get all things AscendOS — plus white-label UIs, a client-facing portal, a Risk Tolerance Questionnaire (RTQ), a goals-based questionnaire, our portfolio mapping algorithm, and, if desired, a mobile app. Fully customizable, you can put your brand (not your custodian’s) front and center without starting from scratch.

Portfolio tools

The days of manually assigning and rebalancing one portfolio at a time are over. Instead, use Apex Ascend Investor and Rebalancer to fine-tune your whole book of business in moments — including fractional trading, tax-loss harvesting, goals-based and values-based investing, and more.

Real-time portfolio mapping and rebalancing

Optimize with precision, allow for customer investment preferences, respond to market changes, and enhance trust with timely, accurate, and personalized portfolio management.

Model Manager and Model Marketplace

Create and edit your own models or use the pre-built strategies available in our Model Marketplace, a library of models created by professional asset managers. Then, set thresholds and receive notifications when rebalancing is required.

Tap into Apex Direct Indexing

Lower barriers by giving your customers access to individual securities they want. Optimize tax savings with strategies like tax-loss harvesting.

Trade explanations

Get detailed explanations with an audit trail for why each transaction is (or is not) proposed, including single securities and fractional shares.

Registration options

Offer brokerage services without the barriers and delays associated with becoming a registered broker-dealer. Choose outsourced regulatory registration, which includes the modern technology of Apex AscendOS, to get you up and running on your own timeline.

Stock Rewards

Reward customers with fractional (or whole) shares of stock, offering a modern alternative to traditional loyalty points and cashback programs. Designed to attract and retain customers at all levels of investing experience.

Differentiate your loyalty program with a fresh and exciting loyalty reward for everyday purchases.

Choose to offer your own stock to build loyalty. If your financial institution is not publicly traded, offer an array of stocks for popular consumer brands.

Thanks to our automated, digital Stock Rewards solution, you don’t need to staff up with financial advisors to make Stock Rewards happen.

Talk to a real person

Get detailed answers to your specific questions by initiating a one-to-one conversation. Provide your information, and one of our reps will reach out.