Available asset classes

- Equities

- ETFs

- Fixed income

- Mutual funds

- Fractional and notional shares

- Options

- Alternatives

Get the modern cloud-native clearing, custody, and trading infrastructure that can catapult your company into the twenty-first century: Apex AscendOS™.

With AscendOS’s cloud-based infrastructure, it’s easier to build, integrate, scale — and operate globally.

AscendOS

Scale. Speed. Reliability. Service. You need it, and AscendOS has it. Seize the moment with access to your own real-time data, fully digital onboarding, and pre-built user interfaces. Operate more efficiently (without staffing up) with integrated products — also available as standalone modules — such as rebalancing, direct indexing, and our Model Marketplace. Plus, our modern APIs are available if you want to do your own development work.

With AscendOS custody, clearing, and trading infrastructure, you can operate more efficiently. And, with our broad network of third-party providers, you have access to the tools you need to keep growing, which can be easier when you:

Operate in real time

Operate in real time with an embedded data warehouse, a built-in ledger, fully digital account opening and funding, money movement, intraday automated rebalancing, and more. Read how Facet increased operational efficiency by 50%.

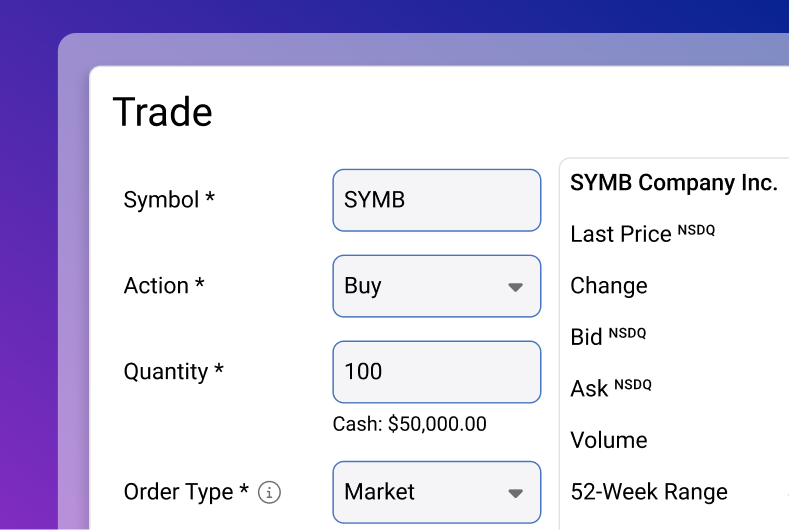

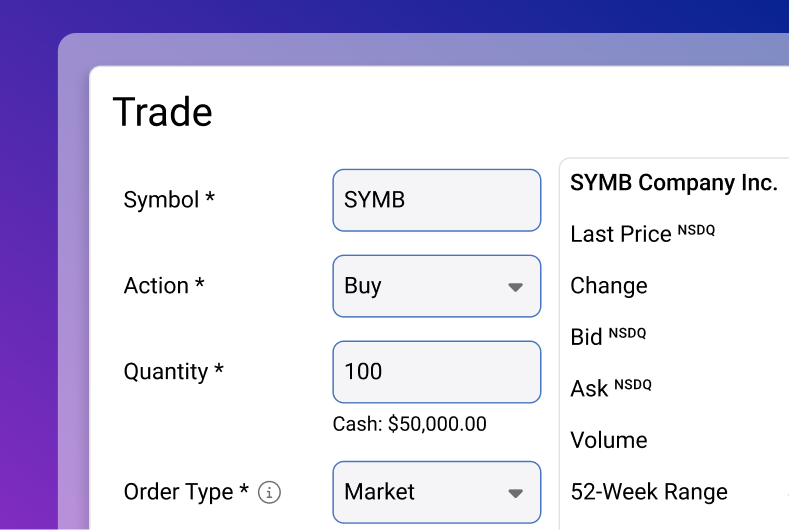

Amplify your trading capabilities

Amplify your trading capabilities with fractional share trading, smart order routing, algorithmic trading, a built-in order management system (OMS), and a sophisticated execution management system (EMS).

Broaden your total addressable market

Broaden your total addressable market with a tech-powered digital-plus-human investor experience we call Augmented Advice™.

Avoid competing with your custodian

Avoid competing with your custodian. Apex does not own retail investment businesses, promote proprietary ETFs, or force you to use our logo instead of yours.

It’s a new era in wealth tech, and Apex is leading the way. Now that we’ve introduced the first cloud-native custody, clearing, and trading infrastructure to the wealth management industry, you can:

Assets & accounts

Expand your offerings to help attract and retain investors throughout their wealth accumulation journeys.

30+ types, including:

Next-gen tools

Take advantage of modern technology designed to help you work with next-gen investors earlier in their investing journeys — so they’re already engaged with you when they’ve accumulated more wealth — that are available via APIs or UIs, depending upon your needs.

Check out how Zoe is unlocking organic growth with these mass-affluent investors.

Explore these Apex services and solutions designed to minimize low-value advisor tasks so they have time to serve more clients:

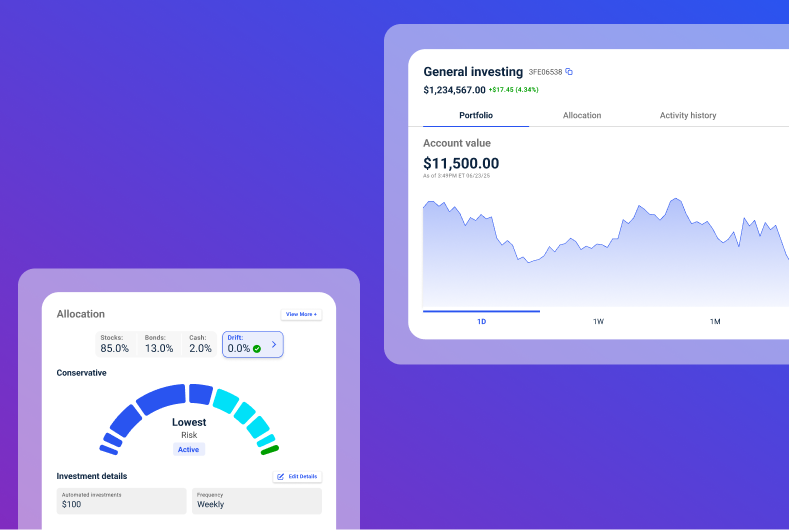

You’ve heard about Apex AscendOS™, our cloud-native infrastructure. Now get to know Ascend Investor, our full-stack investing solution that includes pre-built investor trading experiences (plus user interfaces). This combination of features is designed to support your business no matter how automated or how hands-on you want to be.

One consolidated dashboard to reduce tab hopping. Push-button workflows and automations. Drag-and-drop customization. Access to real-time data 24/7. All designed to unlock more time for advisors to pursue higher-value activities. Give your team the Apex Ascend Workstation to help them:

Catapult your company into the twenty-first century

Dig into the features and solutions that matter most to you. Provide your information, and our team will reach out to answer your questions and show you what real-time modern custody, clearing, and trading infrastructure is.