Apex Rebalancer

Rebalance your whole book in moments, including fractional shares, tax-loss harvesting, goals-based and values-based investing, and more.

Launch and grow with Apex. Leverage our flexible fintech infrastructure and modern tools to bring your unique self-directed, robo, or advisory experience to life.

Focus on growth — not on managing backend complexities. Choose the leading cloud-native, comprehensive platform that features real-time services, automations, streamlined workflows, user interfaces, and a mobile app that lets you build your way. And of course we’re here to help.

Of our 200+ clients, many started with us in their planning stages. That’s because we offer:

Cloud-based technology

that can allow you to build better digital experiences

A consultative pre-sales approach

with a team of industry veterans who can help engineer your solution

A modern developer experience

featuring APIs, SDKs, a sandbox experience, and more — so your team can do more, faster

Lower-tech-lift options

including pre-built UIs and, if you’d like, a client mobile app

Flexible platform and modules

designed to create bespoke solutions more quickly

With AscendOS’s cloud-based infrastructure, it’s easier to build, integrate, scale — and operate globally.

AscendOS

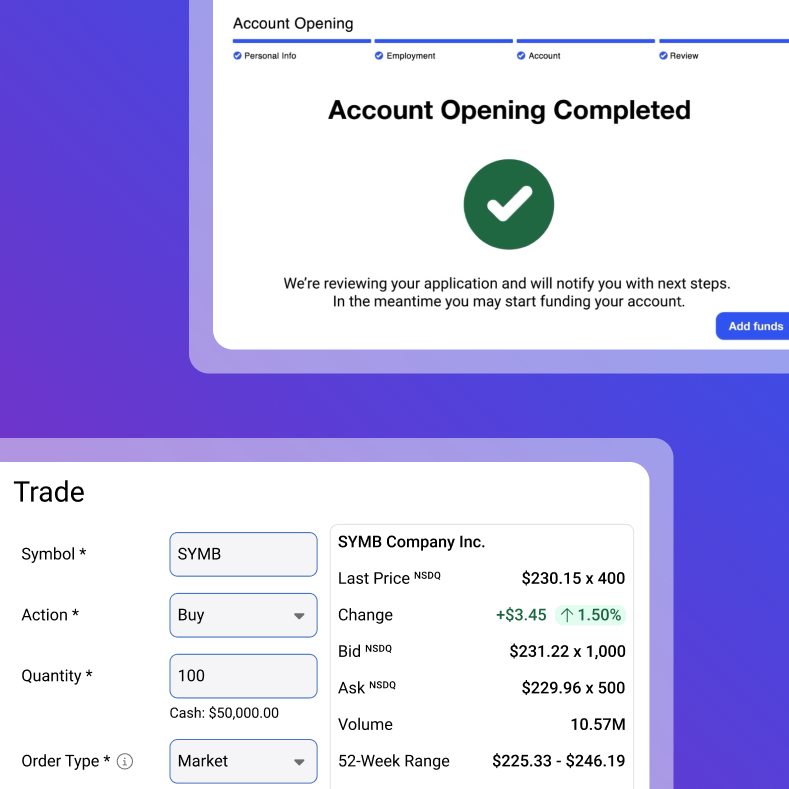

Our clearing, custody, and trading platform was built in the cloud and designed to meet the expectations of today’s digital investors. AscendOS eclipses legacy platforms with real-time (not overnight) services, automated solutions, and many pre-built tools.

Real-time services replace overnight slowdowns

Pre-built tools so you can skip the extra work

*Most securities accounts can be opened in seconds and funded moments later, enabling trading thereafter.

Developer portal

Use APIs, SDKs, sandbox environments, and real-time support to help accelerate deployment of your bespoke digital experience.

“The Apex Developer Portal has revolutionized our approach to innovation. This invaluable tool amplifies our efficiency and strengthens team productivity.”

Siyuan Guo

Wavvest Cofounder and CTO

“Apex provides critical clearing solutions for Stash, helping us better support our millions of customers as they work towards their unique financial goals.”

Brandon Krieg

Stash Co-Founder and CEO

The comments expressed here may not represent all client experiences. These statements are not meant to indicate any guarantee of future performance or success.

Augmented Advice

Where will investors turn when they’ve aged out of robo advising? With 41% of Millennials and 40% of Gen Z* using these algorithmic tools, we’re looking at a significant opportunity to scoop up these clients when they start needing human advice.

That’s why Apex offers a tech-supported, pre-packaged, new business model that blends the robo model with on-demand human guidance. It’s called Augmented Advice, and it’s designed to help you work with next-gen investors earlier in their investing journeys.

The goal of Augmented Advice? Leverage advanced technology to start building deeper relationships with mass-affluent investors now so they’re more loyal to you when they’ve accumulated wealth.

* Fortune Business Insights. “Robo Advisory Market Size, Share & Industry Analysis, By Type (Pure Robo-Advisors and Hybrid Robo-Advisors), By End User (Retail Investors, High-Net-Worth Individuals, and SMEs and Corporate Clients), By Service Type (Direct Plan-based/Goal-based and Comprehensive Wealth Advisory), and Regional Forecast, 2025 – 2032.” April 28, 2025.

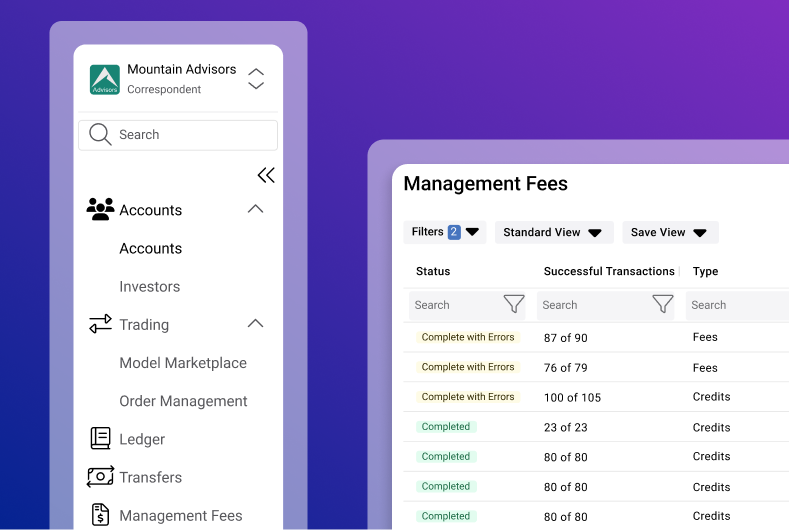

One consolidated dashboard to reduce tab hopping. Push-button workflows and automations to enhance efficiency. Drag-and-drop customization. Access to real-time data 24/7. All designed to unlock more time for advisors and brokers to pursue higher-value activities. Give your team the Apex Ascend Workstation to help them:

Trading

Start with advanced offerings. Expect more from your technology with tools built to redefine efficiency and personalization at scale.

Rebalance your whole book in moments, including fractional shares, tax-loss harvesting, goals-based and values-based investing, and more.

Save time on portfolio construction without sacrificing quality. Access a library of models created by professional asset managers.

Lower barriers to personalization with direct indexing capabilities, giving you new ways to offer customers access to securities they want.

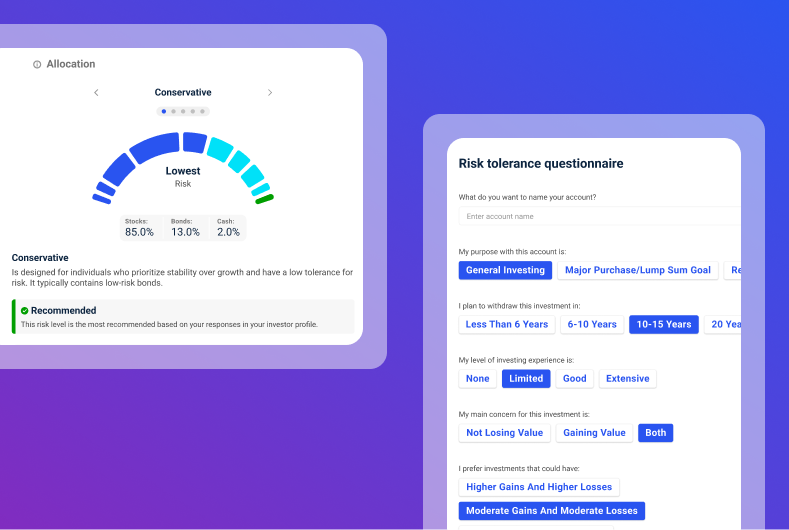

Choose Ascend Investor and get all things AscendOS — plus white-label UIs, a client-facing portal, a Risk Tolerance Questionnaire (RTQ), a goals-based questionnaire, our portfolio mapping algorithm, and, if desired, a mobile app. Fully customizable, you can put your brand (not your custodian’s) front and center without starting from scratch.

Meet service built for faster resolutions and fewer phone calls. Through real-time capabilities, self-service tools, our digital service center, and your own dedicated Apex team, we help you get what you need so you can accelerate growth.

Start fast and with greater flexibility

Get detailed answers to your specific questions by initiating a one-to-one conversation. Provide your information, and one of our reps will reach out.